RWE’s annual UK Community Funds report spotlights major positive impacts on local communities with £6m invested in 2024

05.06.2025

Markus Krebber, CEO of RWE AG: “We are delivering a good financial performance and are well on track with our growth strategy. We apply strict return requirements to the investment of our funds and regularly review our capital allocation. If the risk-return profile in certain areas changes temporarily, we reallocate the capital earmarked for this purpose accordingly. Due to expected delays in the US offshore wind market and in the European hydrogen business, we have decided to buy back shares with a total volume of up to 1.5 billion euros. This underlines our strong commitment to creating value for our shareholders. Given the global demand for clean electricity, we will, however, continue to expand our clean portfolio by investing billions of euros in Europe and the US, thereby also driving forward the energy transition here in Germany.”

In the first nine months of the year, RWE continued to forge ahead with its ‘Growing Green’ strategy. The company has invested €6.9 billion net in expanding its portfolio, primarily in offshore wind power projects in the North Sea and in the construction of new solar and wind farms in Europe and the US. The commissioning of new wind and solar farms increased RWE’s generation capacity – excluding phaseout technologies – to 36.2 gigawatts (GW). The company is currently constructing further facilities with a total capacity of 11.2 GW.

Given the results of the US elections, the risks for offshore wind projects have increased. This also affects RWE's offshore wind project off the east coast of the US, which could be delayed due to outstanding permits. The ramp-up of the hydrogen economy in Europe is also not progressing as quickly as expected. This could delay RWE’s target of building further electrolyser capacity.

Against this background, the company has announced that it will buy back shares of RWE Aktiengesellschaft (ISIN DE0007037129) with a total volume of up to 1.5 billion euros. The share buybacks are set to start still in the fourth quarter of 2024 and extend over a period of up to 18 months.

Positive business development in the first three quarters of 2024

RWE recorded a good performance in the first nine months of 2024. The company produced more electricity from renewables than ever before. Green electricity production reached a record level of 36 terawatt hours (TWh) in the first three quarters – an increase of 14% year-on-year. At the same time, RWE has further reduced its CO2 emissions significantly, by 21% compared to the first nine months of 2023.

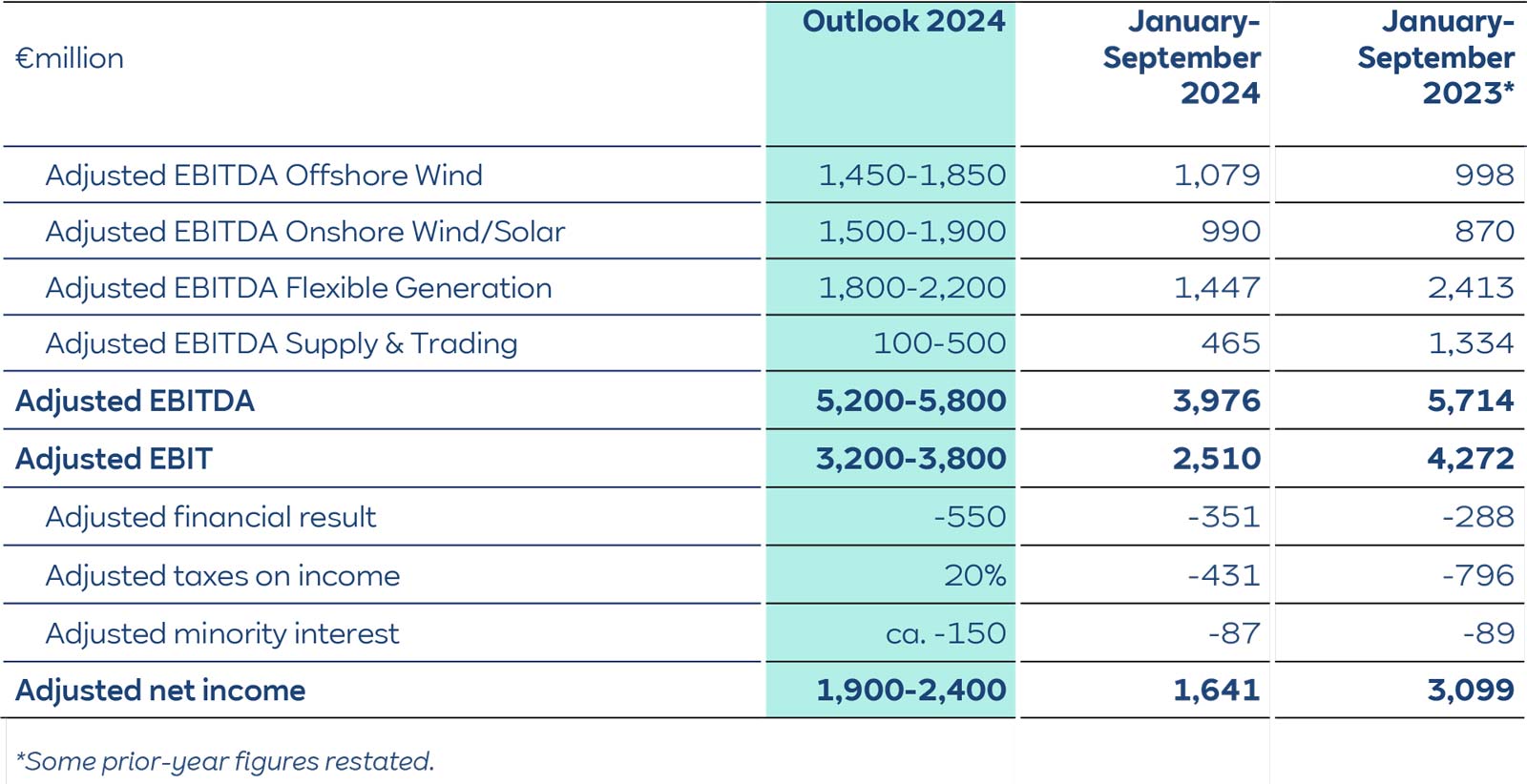

In the first nine months, adjusted EBITDA reached €4.0 billion and adjusted net income €1.6 billion. The Offshore Wind and Onshore Wind/Solar segments recorded a significant increase in earnings. Overall, Group earnings were down on the previous year, as expected, due to lower earnings in the Flexible Generation and Supply & Trading segments.

Offshore Wind: Adjusted EBITDA in the Offshore Wind segment reached €1,079 million in the first nine months of 2024, compared to €998 million in the previous year. The increase in earnings is due to improved wind conditions compared to the previous year.

Onshore Wind/Solar: The Onshore Wind/Solar segment recorded adjusted EBITDA of €990 million, compared to €870 million in the previous year. The positive earnings development is due to the commissioning of new capacity and the recognition of the business activities of Con Edison Clean Energy Businesses in the US for the full three quarters.

Flexible Generation: In line with expectations, adjusted EBITDA in the Flexible Generation segment decreased to €1,447 million in the first three quarters compared to €2,413 million in the previous year. This was due to lower margins on forward electricity sales and lower income from the short-term optimisation of power plant dispatch

Supply & Trading: The segment’s adjusted EBITDA of €465 million was significantly below the prior-year figure of €1,334 million. The strong performance in 2024 did not reach the extraordinarily high level of 2023.

As of fiscal 2024, RWE has pooled the lignite-fired power generation business and the nuclear decommissioning activities as Phaseout Technologies and has been managing them based on adjusted cash flows. This business is no longer included in adjusted EBITDA, adjusted EBIT and adjusted net income.

Continued solid financial position despite high level of investment activity

As of 30 September 2024, RWE reported net debt of €12.2 billion. Due to the growth investments, the leverage factor, i.e. the ratio of net debt to adjusted EBITDA, is likely to increase in the current financial year. However, it is expected to remain well below the self-imposed upper limit of 3.0.

Slightly improved earnings expectations for 2024

The earnings expectations for the full year at Group level have improved. At the beginning of the year, given the significant decline in electricity market prices, RWE anticipated adjusted EBITDA at Group level and adjusted net income would trend toward the lower end of the respective guidance. The company now expects to reach the middle of the respective forecast range due to improved earnings prospects in the Flexible Generation and Supply & Trading segments. The dividend target of €1.10 per share for the current fiscal year remains unchanged.

Click on the image to zoom

Further details on the business development and the earnings forecast for the individual segments can be found in the Interim statement on the first three quarters of 2024. This will be published here on 13 November 2024 at around 7 a.m. CET / 6 a.m. GMT.