Thermal cycling, i.e. starting up and shutting down, can potentially put more strain on some components. We can monitor and manage this with regular, targeted maintenance work, to maintain plant integrity and ensure our fleet remains reliable when called upon.

The UK’s power system is entering a decisive period. As we move towards a cleaner power system, renewables will provide the bulk of our electricity, but gas will continue to play a vital - if evolving - role within this transition.

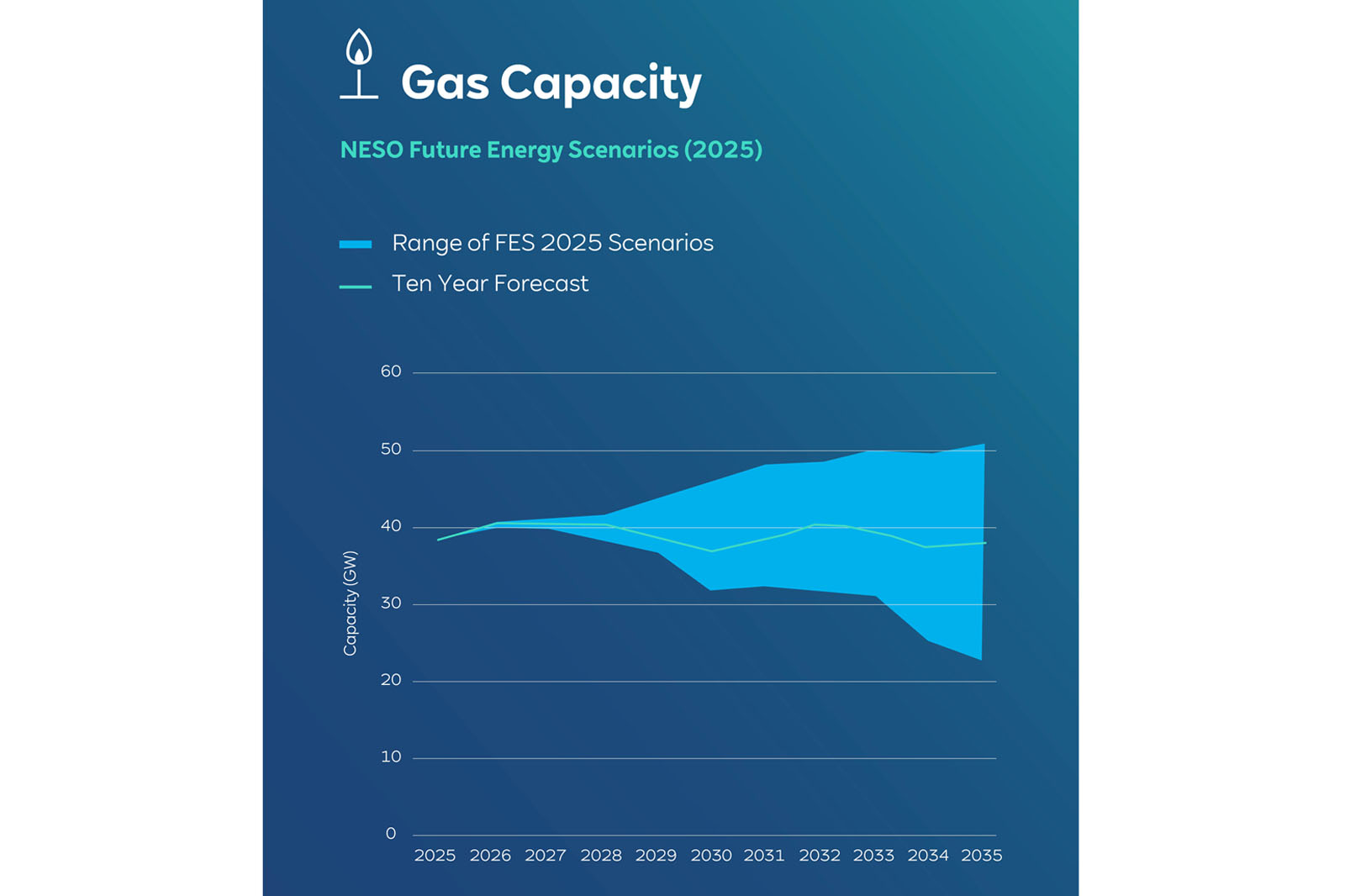

Gas has underpinned the country’s energy security for decades – accounting for around 45% of GB generation at its peak in 2010, and around 30% of supply in 2024. Looking ahead, though we expect gas plants to run much less frequently, gas will remain the backbone of flexibility in a renewables-led grid.

As plants run less frequently and in shorter, more unpredictable patterns, the operational, financial, and regulatory environment around gas will need to adapt. Understanding this evolving role - and ensuring the right market and policy conditions to support it - will be essential to maintaining security of supply at the same time as achieving decarbonisation.

This article sets out RWE’s perspective on what that changing role means from an operational point of view. In a subsequent article, we will focus on the future policy and market framework needed to ensure we can continue to operate our gas fleet safely and securely.